$ 465 million in net outputs: The Ethereum Spot Etfe market has seen its worst day since its start

July was very beneficial for the US Ethereum Spot ETF. The period of the positive flow that has just suddenly ended with clean outputs of $ 465 million. The worst daily result recorded from their start.

$ 465 million in net outputs: The Ethereum Spot Etfe market sees red

The cryptocurrency market originally promised a relatively quiet summer season. Blockchain Ethereum, however, took advantage of this period to get from his lethargy by returning to the position on the front of the stage, with important performances for his cryptocurrency ETH.

Regarding the unprecedented boom on the Stablecoins market, caused by the adoption of the regulatory framework of the brilliant law in the United States. He was very largely based on his blockchain, whose promise to reach $ 2,000 billion visibly attracted investors.

✍ Discover our rating of 10 best websites for ether purchase (ETH) in 2025

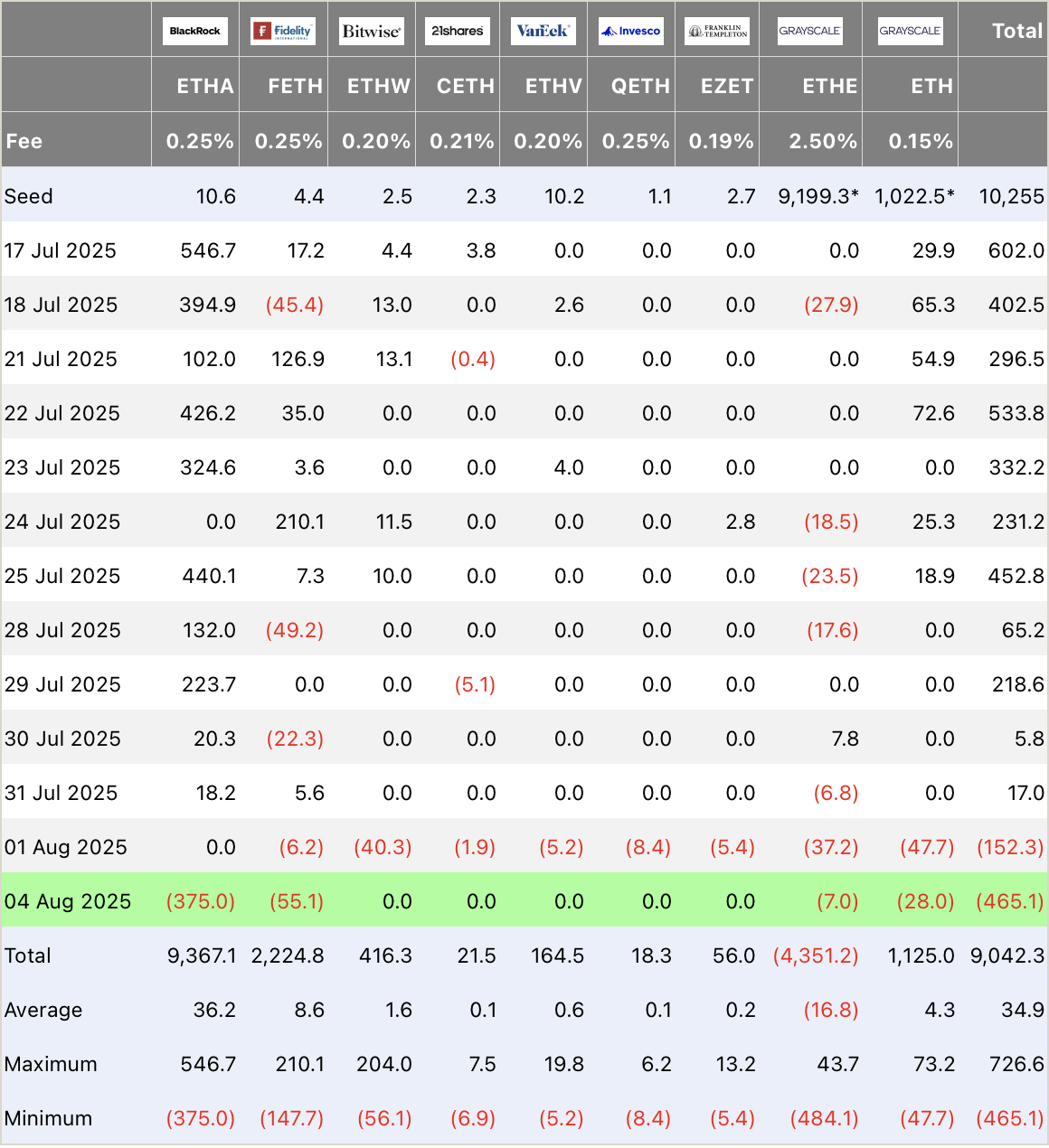

Of course, the party will be short -term. The conversion of the situation, the consequences of which began on August 1, with the outgoing flow on the US Ethereum Spot Ethereum was estimated at $ 152 million, which ended almost 1 consecutive month of clean records.

He forcibly confirmed the trend during the following day, with a total of $ 465 million in net trips, which is already necessary as the largest bleeding of the genre since the start of these funds negotiated in the stock market used in Ethereum.

The flow of American Ethereum Spot Ethe

Buy Ethereum Crypto binance

A decline that does not correspond to a drop in interest

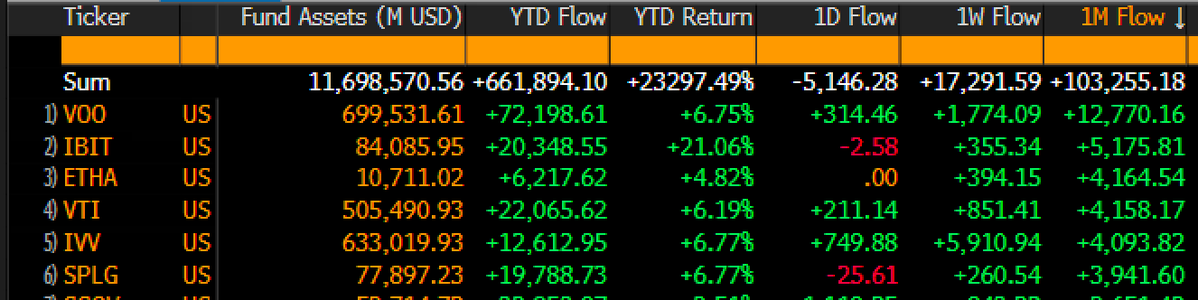

The return of a wand that does not seem to be afraid of analysts of the situation. It should be said that despite these negative results, the Blackrock ETHA fund is part of the TOP 3 ETF – among the 4432 currently in the race – with the most important flows in July, according to the analyst of the sector for Bloomberg, Eric Balchunas.

The Etha Fund’s July in the Blackrock won in the TOP 3 sector

The relatively optimistic vision also shared by the director of LVRG Research, Nick Ruck, faces what identifies as a possible profit without a real impact on institutional acceptance during the Ethereum. Especially in the face of the unprecedented acceleration of the company’s cash register, it increased to Ether (ETH).

Although it may show short -term profits after the recent ETH rally, this does not necessarily reflect a decline in institutional demand, especially due to the record contributions of $ 5.4 billion in this industry in July and the accumulation of ETH.

🗞 Approval of betting on Ethereum Spot Ethere could “redefine the market”

Face in the face of a strong acceleration of the Ethereum Spot Ethere market during July, some will say that the fall can only be violent and the reality of the market seems to prove them correctly. However, it should not be seen too quickly by the loss of interest by investors, especially due to the promise of a completely renewed market with further opening to download.

Get up to 40 € by creating an account on Batvavo*

Sources: Farside, Eric Balchunas

Crypto newsletter n ° 1 🍞

Get a summary of crypto messages every day e -mail 👌

Some content or links in this article may be an ad. Cryptoast studied presented products or services, but cannot be responsible for any damage or loss associated with their use. Investment in cryptocurrencies involves risks. Invest only what you are ready to lose.