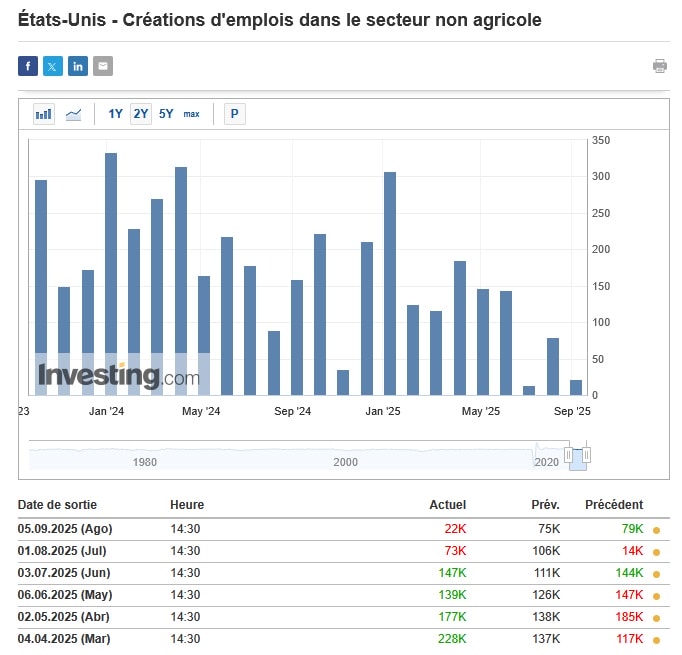

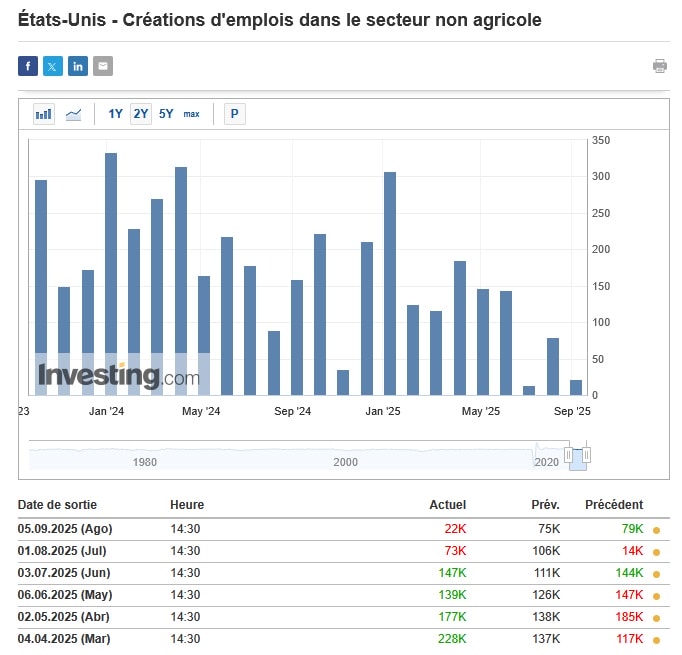

Employment (NFP) is in the US on half mast: Fed should reduce its main rates and strengthen bitcoins

Fed at the foot of the wall. This Friday 5th September, Employment statistics were eagerly awaited UNITED STATES. This is especially Creations (Nonfarm PayrollOr NFP) and the characters unemployment who are carefully monitored by the financial actors because they have become the main indicator of the monetary policy of the Federal Reserve (Fed). Really, Jerome PowellFed President to mention Jackson Hole in his speech The key rates of the US central bank can be re -reduced If the labor market has deteriorated too much, it has condemned inflation As a less important indicator for the procedure to be followed.

- The Fed found itself under pressure from the publishing of grim statistics of employment in the United States.

- Employment creations were much lower than expectations and unemployment increased slightly, which could encourage the Fed to reduce its interest rates.

Only 22,000 work of creations and unemployment that stagnates 4.3% in the US

Posted this Friday 5th September 2025 at 14:30. (French time) from Statistics of the Labor Office (Bls) from the United States, Non -agricultural work creationsOr NFPare a key indicator Employment health in the country of uncle alone.

And these are good characters Morther who have just fallen because Nonfarm Payroll only 22 000 work creations In August against 75,000 expected As expected, the market! In addition, this is also followed by the two previous months also very low.

On the side unemploymentThe situation is slightly less dramatic, with increase 4.2 at 4.3% Which players on the market perfectly expected (4.3% expected).

Bad NFP = Reduction of Fed rates and Bitcoins increase?

If employment in the United States is not in good shape, it could have bull’s consequences For Bitcoin (BTC) and the cryptocurrency market. As shown in the introduction, Federal reserve and his president Jerome Powell have recently switched more to protect employment than when inflation checks Decide on their Monetary policy.

Particularly famous Recovery of a decrease in fed guide ratesvery (very) expected actors of marketsassets ” Risk »»Like action and cryptos. And these same actors now seem convinceWith the employment data that has fallen today, the interest rate decrease will take place From September 17th nextat the next meeting Federal Committee on Open Market (Fomc).

In fact according to the tool Fedwatch CME groups (below), financial analysts exclude now completely and maintenance rates as this is so Since December 2024 and the last decline. They really are on 88% for a 25 points drop basic rates and even 12% see a bigger drop, on 50 points. In other words, 100% convinced of a decline From now!

The latest important statistics before the verdict of 17 September, Inflation data, especially ICC (Consumer price index) that will drop next Thursday, September 11 2025. If it is stagnation from the last few months continuouslyFed and Jerome Powell will not really have any pretext to reduce these famous instructions. What to help Bitcoin and the market crypto? Wait and see.

(Tagstotranslate) banks