Crypto ETPs in the green, Bull Run underway?

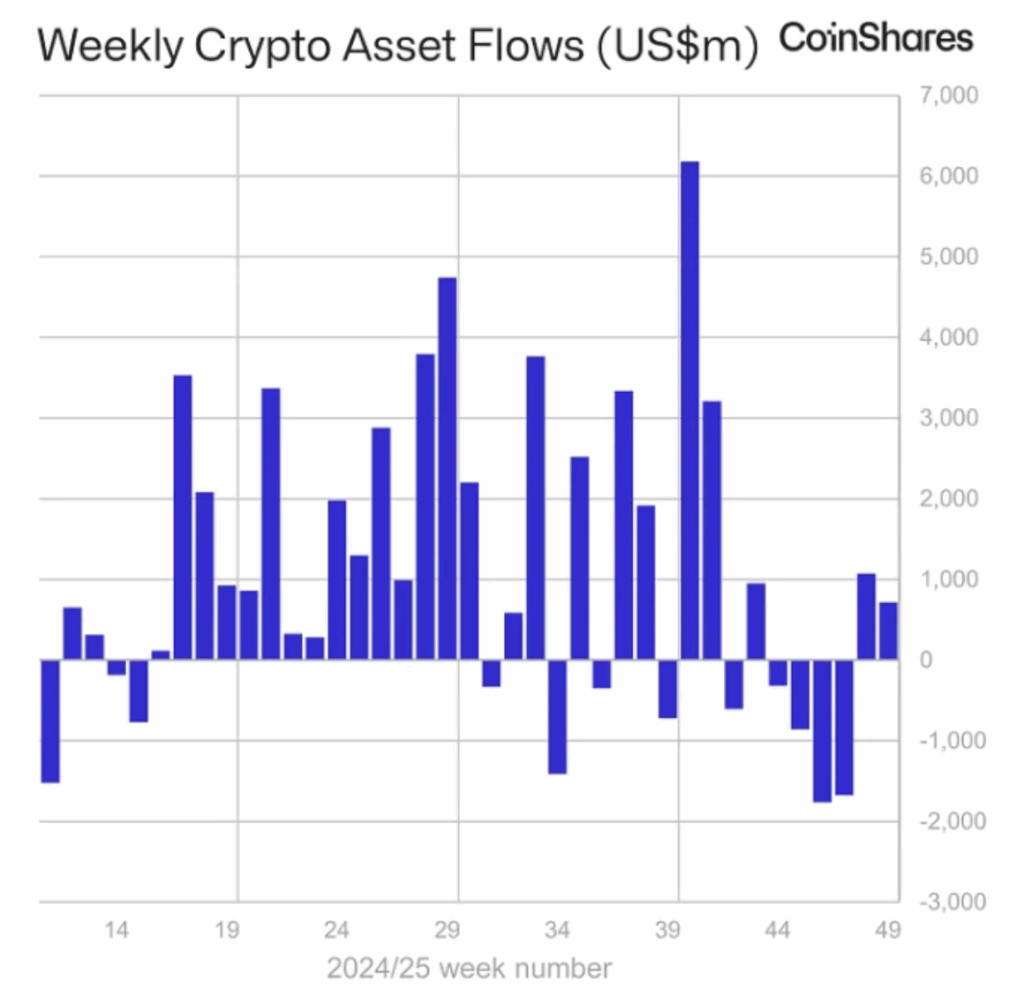

THE crypto investment products end the week in the greenwith a significant return on incoming flows. According to data published by CoinShares, digital ETPs saw net inflows of $716 million, a second week of growth after more than $1 billion in the previous week.

This dynamic is accompanied by a decrease in short positions, a symptom gradual release of negative feelings which has dominated in recent months. However, movement remains mixed, particularly in the United States, where spot bitcoin ETFs have seen outflows, bucking the overall trend.

Crypto ETPs and ETFs have been relaunched

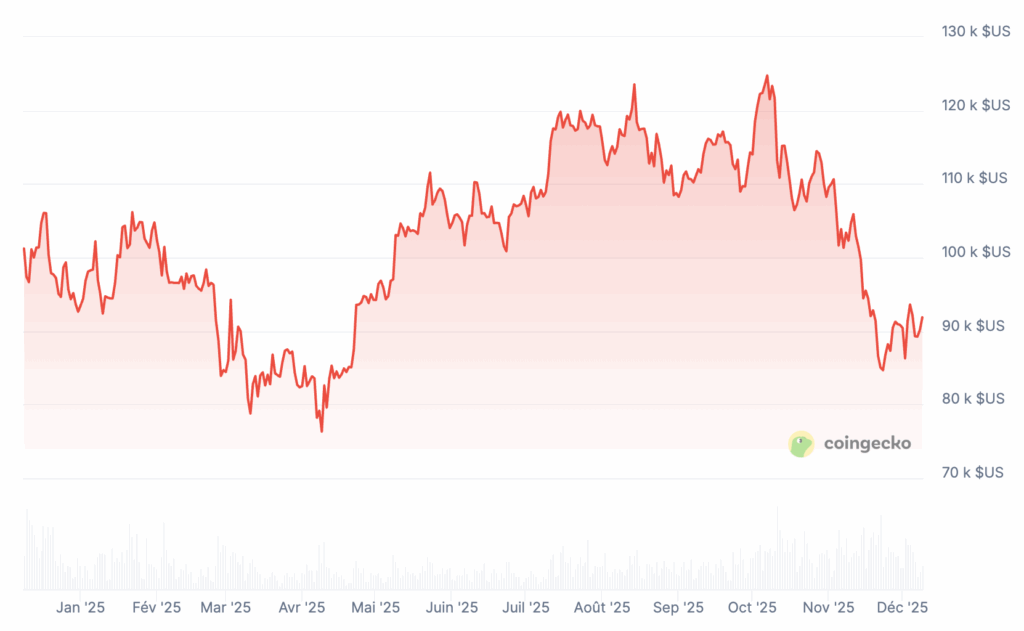

Positive flows are mainly concentrated at the beginning of the week, before a slight decline on Thursday and Friday, attributed to renewed inflationary pressures in the United States. Despite this slowdown, Bitcoin and Ethereum responded well: BTC has crossed $92,000 and ETH is nearing $3,200.

THE the assets under management of ETP thus reach 180 billion dollarsstill far from the peak of 264 billion, but clearly trending upwards. Inflows are largely driven by the United States, Germany and Canada, confirming the reactivation of the institutional segment. Bitcoin-indexed products still dominate the market with $352 million inflows.

Short-bitcoin ETPs saw their strongest outflow since March, a move that suggests investors believe the phase of pessimism is coming to an end. Ethereum pulls in $39.1 million, although US ETFs continue their outflows.

On the altcoin side, XRP confirms its momentum with an inflow of $245 million and is now over $3.1 billion year-to-date Chainlink had its best week yetsupported by Grayscale’s launch of GLNK in the United States.

Towards a bull run comeback?

All these signals allow investors to ask themselves a question to know if the market is starting a new bull cycle. The current pick-up in flows, prices and institutional interest suggests a change in trend, even as US macroeconomic indicators continue to weigh on near-term visibility.

As always, Bitcoin’s development will be closely watched. Around $92,000, the asset is returning to an area that could trigger an acceleration on a sustained breakout. If Bitcoin could sustainably rise higher $95,000, that would be a decisive signal activate a more pronounced bullish phase.

Altcoins also seem poised to take over if conditions improve. XRP benefits from a specific location, with steady flows and relatively limited volatility. If it sustainably exceeds $1.20, the market could see a quick move.

Solana has a more cyclical profile but is still very reactive during expansion phases. The dynamism of its DeFi ecosystem and high activity on the chain suggest an increase if the context becomes more favorable.

In any case, the development of the ETP shows that confidence is beginning to return among the largest investors. In fact, institutional actors are generally well informed and prudent.

On the same topic: