Hyperliquid offers its own native stable, USDH – and other things

Hyperliquid, known for his eternal Dex in full ascent, has just announced USDH, his own native stable. USDH, directly embedded in hyperliquide, can become the cornerstone of a complete and self -sufficient ecosystem.

Hyperliquid wants its native stablecoin

Dex permanent for a real ecosystem. Hyperliquid now has much more than more than a platform for cryptocurrency exchange, now has many tools that will continue to increase their dominance, especially through builders, HIP-3 and Corewriter codes. Hyperevm, which develops many protocols, today shows $ 3.18 billion on TVL.

One of the angular hyperliquid stones is stablecoins. USDC, more specifically, Stablecoin de Circle, which is also the second more capitalized on the market. The reason is simple: to trade hyperliquide, it is necessary to provide liquidity by storing USDC across the bridge Arbitrum – Hyperliquid.

The USDC-Hyperliquid duo is now obtained for all DEX users, but that could change very soon. Hyperliquid teams have just announced that the ecosystem will soon have its native stable: USDH.

📍 Where and how to buy hyperliquid hyper crypto?

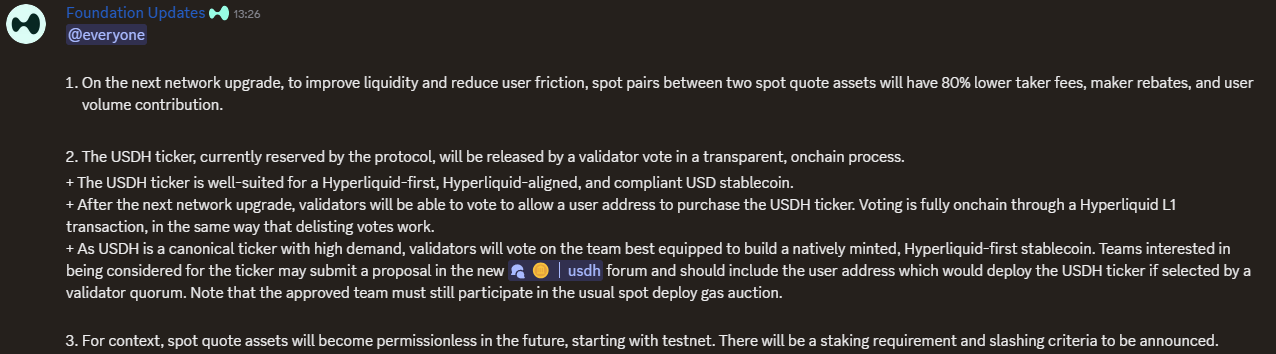

Screen image from Discord of Hyperliquid

Specifically, we will learn that Hyperliquid has reserved Ticker USDH to start Stablecoin supported by the US dollar. The USDH start -up process will be carried out in the same way as the elimination, ie on the basis of the established management system. Valinators will have to choose a developer team that seems best for them to supervise this new Stablecoin. It is already possible to offer your application through the reserved channel.

The way USDH would be collateralized was not discussed during the announcement.

Unlike USDC, USDH will be natively released on Hyperliquid. This means less technical risks (especially the bridge), but also better integration into platform products: collateral for derivative products, shoe trading, or even future uses in hyperevmu defines.

Long or shorts over 100 cryptos with hyperlikvid

Reduced costs and without permission

Another novelty is expected on the trading side. Specifically, the cost Taker In pairs Quotation (USDC/USDT, USDC/USDC, etc.) will be reduced by 80 %and discounts for manufacturer It will also be reduced by 80 %. Likewise, to prevent abuse, the volumes recorded in these pairs will be reduced by 80 %.

With a reduction in 80 % of the costs, referees and high -frequency trading could be seriously installed on hyperliquide. This would attract new players who would bring liquidity and mechanically tightened the differences between purchasing and sales prices (range). At the same time, the business experience would approach centralized exchange, but with the transparency of DEX and the effectiveness of the chain order.

👉 Get more with your euro stablecoins? Triggers a suitcase with an automated yoeur yield

Eventually hyperliquid announced that point pairs Quotation It will soon be a permit, that is, anyone (with a minimum of the Humbuk tokens in Sting) will be able to run a new pair of this type. The chopping process will also be set up to prevent any abuse.

€ 20 in Humbuk offered with SBHHYPE code when registering at Swissborg!

Crypto newsletter n ° 1 🍞

Get a summary of crypto messages every day e -mail 👌

Some content or links in this article may be an ad. Cryptoast studied presented products or services, but cannot be responsible for any damage or loss associated with their use. Investment in cryptocurrencies involves risks. Invest only what you are ready to lose.