The French government is doing better … without doing well: three billion won, forty looking for

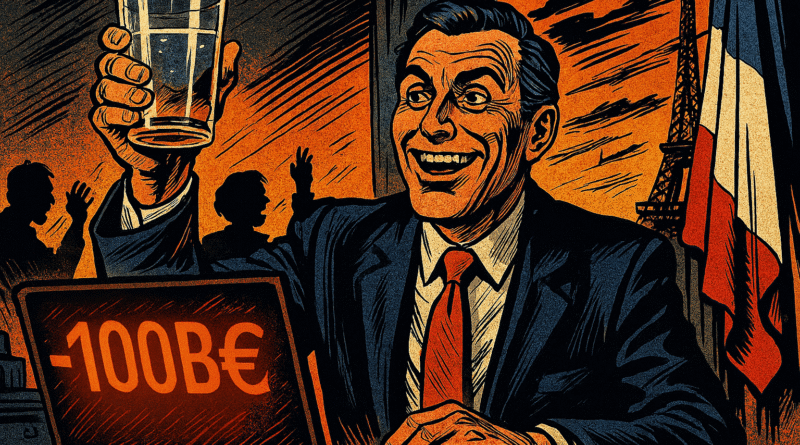

August there is and his share in cold Potch. While the temperatures rise, the number decreases. France is in full budget of turbulence, between European pressure, internal arbitrans and increasing social tension. However, the number acts as peace of mind: the state’s budget deficit is € 100.4 billion at the end of June. A slight improvement compared to the previous year. But should we really rejoice? If some indicators appear to increase the economy, the situation remains tense before it seems. Overview of overheating budget landscape.

In short

- The deficit will reach EUR 100.4 billion at the end of June, a decrease of 3 billion.

- Tax revenues increase due to the stopping of the energy shield to energy.

- The costs remain high, especially debt and public wages.

- 40 billion savings remain for the budget of France from 2026.

A symbolic drop that does not say everything

Bayra’s government is trying to throw away. After two nail exercises, France has a reduced deficit of EUR 3 billion compared to June 2024. From 103.47 to 100.4 billion euros : obviously improvement. However, this decline is mainly due to cyclic strengthening.

The end of the price label and the increase in certain taxes artificially subsidized tax income. This reach 163.3 billion euros (+7 billion)He drew the income tax and income tax.

But in detail, the mechanics remains confiscated. Net spending still reaches 262.1 billion euros. And the accusation of public debt weighs more than ever: +6 % in one year. The same for wage account, by 2.4 %. Another black hole is added: Special cash register accounts degraded by 5.9 billion eurosEspecially due to postponed reimbursement associated with the health crisis.

In short, the curve drops, but the slope remains stiff. And economists warn: Without structural reforms, it will not be best to last.

Economy doped for exceptional revenue

When the accounts are bad, press the screws. Since February, The state froze or canceled loans of EUR 17 billion. Objective: Maintain European obligations and calm markets. On the income side, there is a growth of +4.2 % more than one tax context than an economic recovery. Stopping energy aid has strengthened the return, but it is Rustin, not a solution.

Consumption does not follow. Saving climb, VAT stagnates. Bercy is concerned in silence, because an economy that no longer buy is an economy that slows down. The equation that Banque de France knows well.

The climate remains flammable in the political area. The 40 billion savings to find for 2026 The assembly has been shaking. On the left and on the right, the threat of censorship multiplies. Because each euro stored is likely to be an amputated public service, planned assistance, a frozen position.

And during this time Brussels monitors grain and resembles a 3 % deficit rule compared to GDP. A cap that France is trying to focus.

France, Economy and Trust: A equation with several unknowns

With this slight decrease in deficit, the government is trying to regain control. But the road is dotted with pitfalls. Standard & Poor’s has already reduced the French comment in May 2024 and pointed out ” Lack of sustainable tax consolidation ». And the auditors’ court insists: without reform as a result of reform, the debt could endanger the long -term economic stability.

In the autumn 2026 Finance Bill He promises to be explosive. Biga plays Big: His most remain fragile and the country shows signs of fatigue on his face.

Economic standards you remember:

- The deficit reaches 100.4 billion euros at the end of June (vs. 103.5 billion euros in 2024);

- Tax revenues increase by € 7 billion thanks to the stopping of the price shield;

- Debt load increases by 6 %, payroll by 2.4 %;

- Special accounts accuse a hole of EUR 20.8 billion, ie EUR 5.9 billion more than in 2024.

While France is trying to regain the appearance of balance, it also looks like the United States. There is discussed about inflation of gallop and abyss. For investor Ray Dalio you can find Ramparts on the side of public policies: gold and bitcoins must be part of any wallet that seeks to survive inflation and massive debt. A lesson that could go through the Atlantic.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

Blockchain and crypto revolution! And the day when the impacts will be felt on the most vulnerable economy of this world, I would say against all the promises that I was there for something

Renunciation

The words and opinions expressed in this article are involved only by their author and should not be considered investment counseling. Do your own research before any investment decision.